Where Credit meets confidence

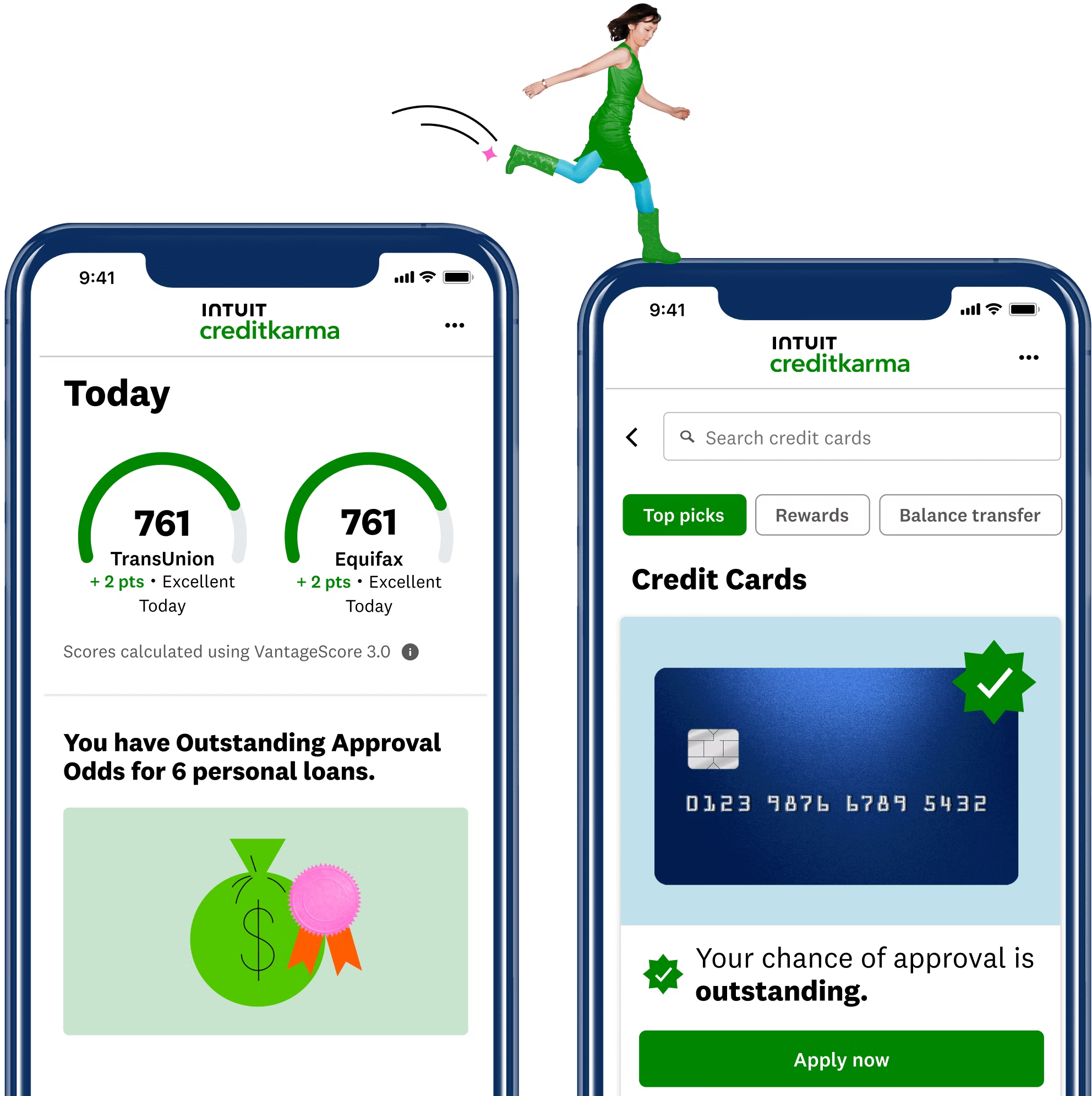

ScoreTracker

It is now easier than ever to track all your scores with simple charts or in-depth information.

ScoreBuilder®

See exactly what is helping or hurting your credit score. Get your 120-Day Plan to a better score.

ScoreBoost™

Get your best score before you apply for credit. See how your spending affects your score.

Get Started Repairing your Credit by fixing inaccuracies

Download the app and join thousands of members making financial progress.

Getting Started is as easy as 1-2-3

No obligations. Cancel anytime.

Speak with an expert

Phone consultation to ensure our services will benefit your unique situation, and not waste your time!

Get the show on the road

Signing up takes minutes; we only need a few pieces of info and a credit report from each Bureau to start.

The battle begins

We go after creditors and Bureaus on your behalf, handling all intricate paperwork and document processing.

Credit Monitoring Membership

- ScoreTracker

- ScoreBuilder®

- ScoreBoost™

- Money Manager

- Smart Credit Report®

- $1 Million Fraud Insurance

- PrivacyMaster®

7-Day Trial For

$1.00

Premium

Membership

$21.99/mo

Get Credit Monitoring and Your 3B Credit Reports & Scores

See What Clients Are Saying

We've helped thousands of people understand how credit repair works, and we may be able to help you, too.

Enjoy the lifestyle you deserve

What you don’t deserve is to be penalized for years and years because of financial mistakes made in the past. Your credit doesn’t have to hold you back forever, and the debt that comes along with it doesn’t have to be scary and stressful. Every month we help thousands of clients get their credit repaired and debts taken care of so they can get the job, car, house, credit cards, they need to get on with their life. We’re big believers in second chances, and we’re prepared to work hard so you and your family can live the lifestyle you’re working hard to achieve. With CreditVana®, our goal is to provide you with a simple platform for your money and credit all in one place, and with innovative tools to help you rest assured that your credit accounts are being monitored 24/7.

Your credit score is one of the most valuable financial tools you have in life. With SmartCredit®'s credit monitoring services, you can insure yourself against identity theft and track not only your credit reports, but your daily credit and financial transactions as well.

Your credit report is like a report card of your entire financial history. With SmartCredit®, you quickly receive your 3B credit reports & scores. Plus, we make them easy to read, so you can regularly check their accuracy and better understand your credit score!

With more than nine million Americans experiencing credit card fraud and identity theft each year, the need for identity theft insurance grows every day. Our $1 Million Family Fraud Insurance gives you peace of mind in the event that you or a family member in your household become the victim of identity theft.

Disputing an error on your credit report can seem complicated to even the best financial gurus, but it doesn't have to be. Our Action buttons do the hard work for you so that all you have to do is select a reason for your dispute and wait for a decision while our Action buttons take your communication directly to the source. There has never been an easier way to dispute credit report inaccuracies.

Your credit score plays a vital role in credit decisions and can open the door to many opportunities. Enroll with SmartCredit® today and not only are you provided with the different types of credit scores that exist, but also credit score tools that allow you to take more control of your credit score.

Sign up with SmartCredit® to get your credit report and to start controlling your future credit score today!

Your credit report contains several pieces of crucial information, such as your credit history, the different types of credit you have previously used, and for how long, any outstanding debts you may have, and how frequently you made payments on the agreed-upon due dates every month.

The data within your credit report is used by various lenders and creditors to determine your financial responsibility, and whether or not you are a risk in terms of extending credit.

Credit reports contain data from four main categories of personal and financial information.

Personally Identifiable Information (PII): Refers to personal information that can be used to identify you, such as your full name, current and previous address, date of birth, and social security number.

Credit Accounts: Each credit account you have opened with various creditors and lenders.

Credit Inquiries: Inquiries are a record of who has accessed you credit report and on what date. Hard inquiries are made each time you apply for a new line of credit, while soft inquiries are made each time you view your credit report.

Public Record and Collections: Refers to personal information such as bankruptcies, debt collections, and any pending legal issues.

However, credit scores are not shown on your credit report because they represent a different insight into your credit. Credit reports indicate your credit activity, while credit scores reflect a calculation of your credit activity.

Credit scores are used by financial companies to help them determine if a consumer has any potential risk in extending them credit. Most often, credit scores are used by financial institutions, credit card companies, and car dealerships to determine whether or not they should provide you with credit, and what the terms, interest rate, and down payment of the credit will be.

Credit score calculations are placed into five categories between the ranges of 300-850:

- Poor: 579 or below

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800 or above

Generally, credit scores above 670 are considered good, and a credit score above 800 is considered to be an excellent credit score. Most consumers fall somewhere between 600 to 750.

As mentioned, the benefit of having higher credit scores represent more financial responsibility, thus providing creditors and lenders with more confidence that you will be able to repay any future debts as agreed upon. Get a credit report today and see where your credit score stands.

To find out precisely what is in your credit report, sign up with SmartCredit® to easily receive and manage your 3-Bureau Report & Scores.

The credit reporting agencies are responsible for maintaining your credit report and providing the data to various creditors and lenders who request it. There are three major credit reporting agencies.

- Equifax

- TransUnion

- Experian

However, information that is provided to each of the three credit bureaus may be different due to the individual creditors furnishing your data. For example, one credit bureau may have more or fewer inquiries than the other two, which could potentially produce different looking credit reports.

Because of this, it's recommended that you request your credit report with each of the three major bureaus so that you have a comprehensive look into your financial standing, and quickly identify any difference that could potentially be affecting it.

Monitoring your credit is tough to do on your own. Your SmartCredit® membership provides you with the absolute best platform for your money, credit, and identity all in one.

Sign up to find out how you can start controlling our future credit score today!